The CM Punjab Loan Scheme Apply Online process has officially started, offering an incredible opportunity for youth, small business owners, and startups across Punjab. This initiative by the Chief Minister of Punjab aims to empower the province’s youth by providing interest-free or low-interest loans for entrepreneurial ventures. If you’re looking to register, apply, or log in to your account, this guide covers everything you need to know.

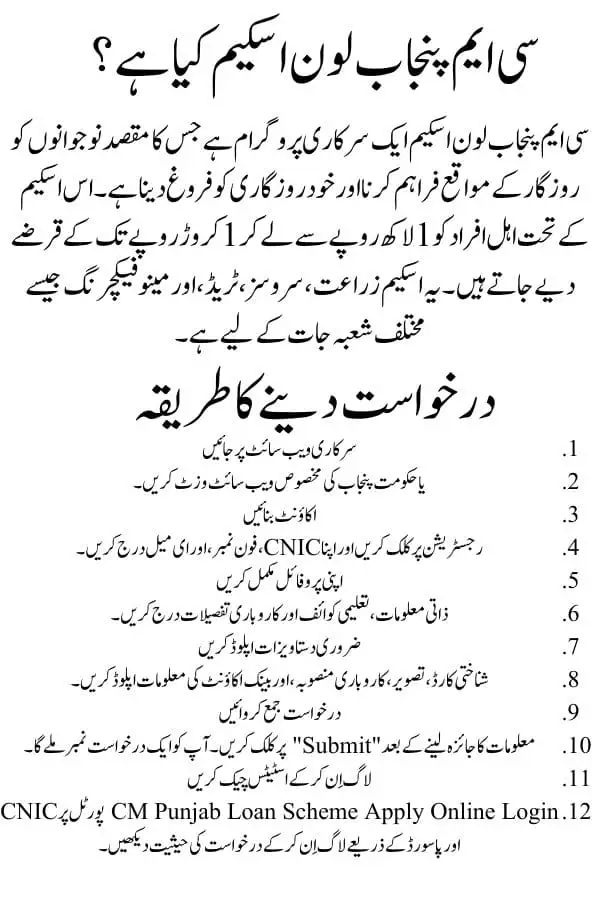

What is the CM Punjab Loan Scheme?

The CM Punjab Loan Scheme is a government-backed program designed to reduce unemployment and promote self-employment among the youth of Punjab. Under this scheme, eligible individuals can access financial assistance ranging from Rs. 100,000 to Rs. 10,000,000. The scheme targets various sectors including agriculture, services, trade, and manufacturing.

Also Read: Benazir April 2025 Payment Eligibility 8171

CM Punjab Loan Scheme Apply Online – Step-by-Step Process

The CM Punjab Loan Scheme Apply Online system is user-friendly and accessible through the official government portal. Here’s how you can apply:

- Visit the Official Website: Go to https://bisp.gov.pk or the official Punjab government site dedicated to youth and business loans.

- Create an Account: Click on the “Register” button to create a new account with your CNIC, phone number, and email.

- Complete Your Profile: Fill out your personal, educational, and business-related details.

- Upload Required Documents: You will need to upload scanned copies of your CNIC, photographs, business plan, and bank account details.

- Submit Application: After reviewing your details, click on “Submit”. You will receive an application number for tracking.

- Login to Track Your Application: Use your CNIC and password on the CM Punjab Loan Scheme Apply Online Login portal to check your loan status.

CM Punjab Loan Scheme – Eligibility Criteria

| Eligibility Criteria | Details |

|---|---|

| Age | 18 to 45 years |

| Domicile | Punjab only |

| Business Type | New or existing |

| Educational Qualification | Minimum Matric (for some loan categories) |

| Guarantor Requirement | Yes (depending on loan amount) |

| Business Plan | Mandatory |

Key Features of the CM Punjab Loan Scheme

- Loan Amount: From Rs. 100,000 to Rs. 10 million

- Interest Rate: 0% to 5% depending on category

- Repayment Period: 2 to 5 years

- Processing Time: Fast-track approval within 30 days

- Sectors Covered: Agriculture, IT, Services, Manufacturing, Trade

Benefits of Applying Online

The CM Punjab Loan Scheme Apply Online system allows applicants to easily submit their documents and track progress without visiting government offices. The online portal ensures transparency, saves time, and reduces the hassle of manual submission.

Important Tips for Successful Approval

- Create a Strong Business Plan – A clear and realistic business plan increases your chances of approval.

- Ensure Document Accuracy – Any errors in CNIC or financial records may delay the process.

- Use a Valid Mobile Number – You’ll receive OTPs and notifications regarding your loan application.

- Check Portal Regularly – Use the CM Punjab Loan Scheme Apply Online Login to monitor updates and respond to queries.

Final Thoughts

The CM Punjab Loan Scheme Apply Online portal is a major step toward economic development and youth empowerment in Punjab. Whether you’re starting a small business or expanding an existing one, this scheme offers financial support with minimal interest rates and easy terms.

Make sure you apply before the deadline and follow all guidelines for a smooth and successful application process. If you’re eligible, don’t miss out on this golden opportunity to transform your future.